Motor Fuel Tax Training Courses

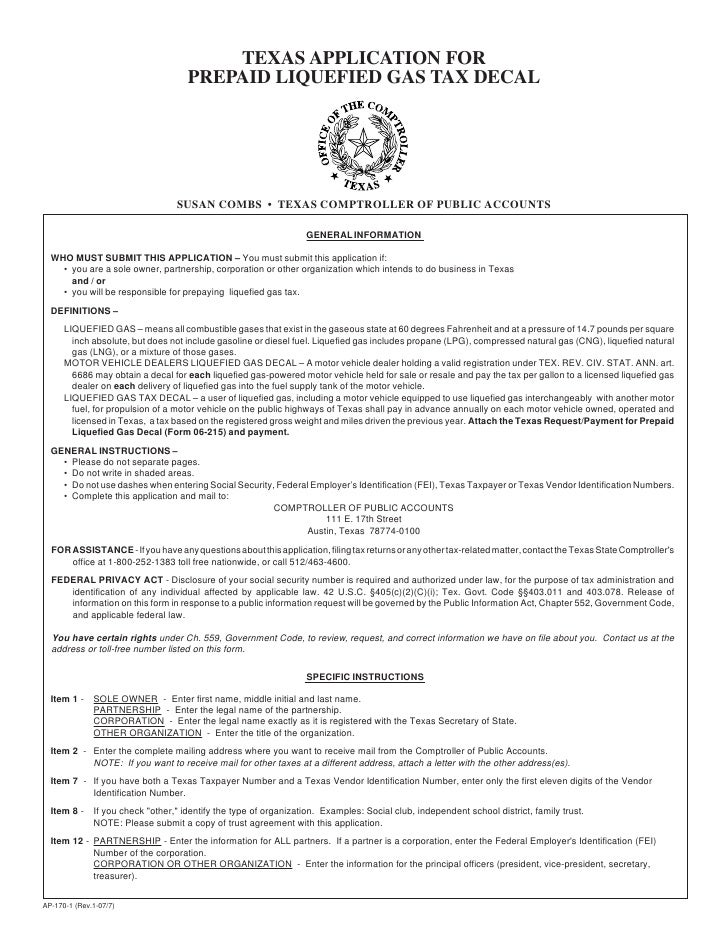

Motor Fuel Tax Training Courses. You can claim a deduction for the following general course expenses: The international fuel tax agreement audit manual has been subject to amendments under section r1600 of the articles of agreement, which were effective january 1, 2017.

TCI Gas Tax Hurting Families While Little from oceanstatecurrent.com

TCI Gas Tax Hurting Families While Little from oceanstatecurrent.comAny business buying, selling, storing or transporting fuel in south dakota. Course and tuition fees, if you pay these; We offer a variety of training solutions for gas, steam, and aero product lines (heavy duty gas turbines, steam turbines, aeroderivative turbines, generators, hrsgs boilers, air quality controls and control systems).

Our factory qualified instructors are dedicated to providing excellence, quality and consistency for all service training. Sunday, july 24, 2016 to thursday, july 28, 2016.

Cat® operator, technician & safety training. A fuel excise tax on motor fuel, special fuel, aviation fuel and alternative fuels used to propel a motor vehicle.

Api learning is an enhanced training experience on an intuitive learning system. Motor fuel tax applies to fuel sold for use or used to power internal combustion engines (e.g.

All technical training courses are offered by our rotax authorized distributors/authorized training organizations. Compressor, hot section, power section, accessory gearbox and reduction gearbox • systems:

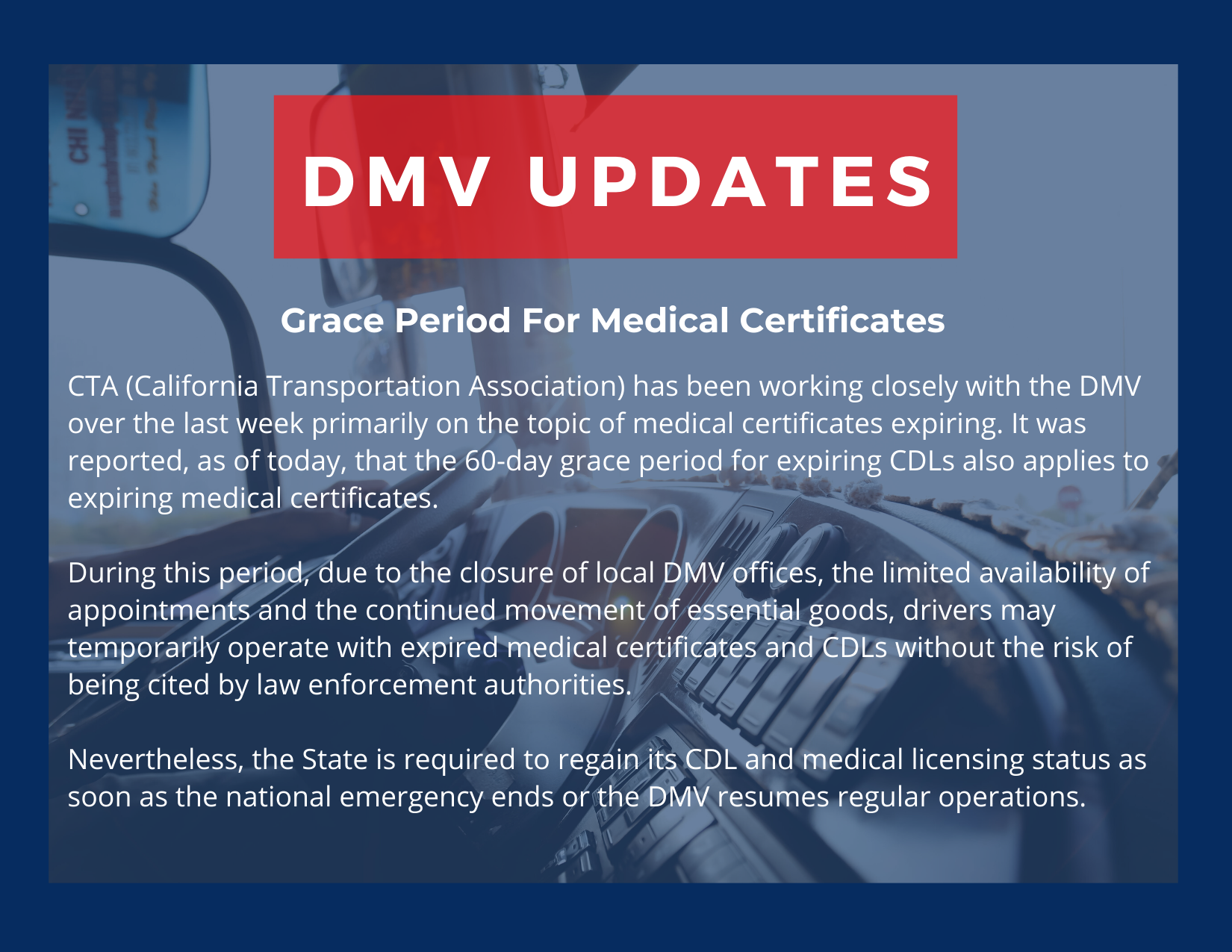

Descriptive course and guide to troubleshooting training for pt6 engines technicians focused on resolving problems in the field. People who operate qualified motor vehicles are subject to ifta licensing.

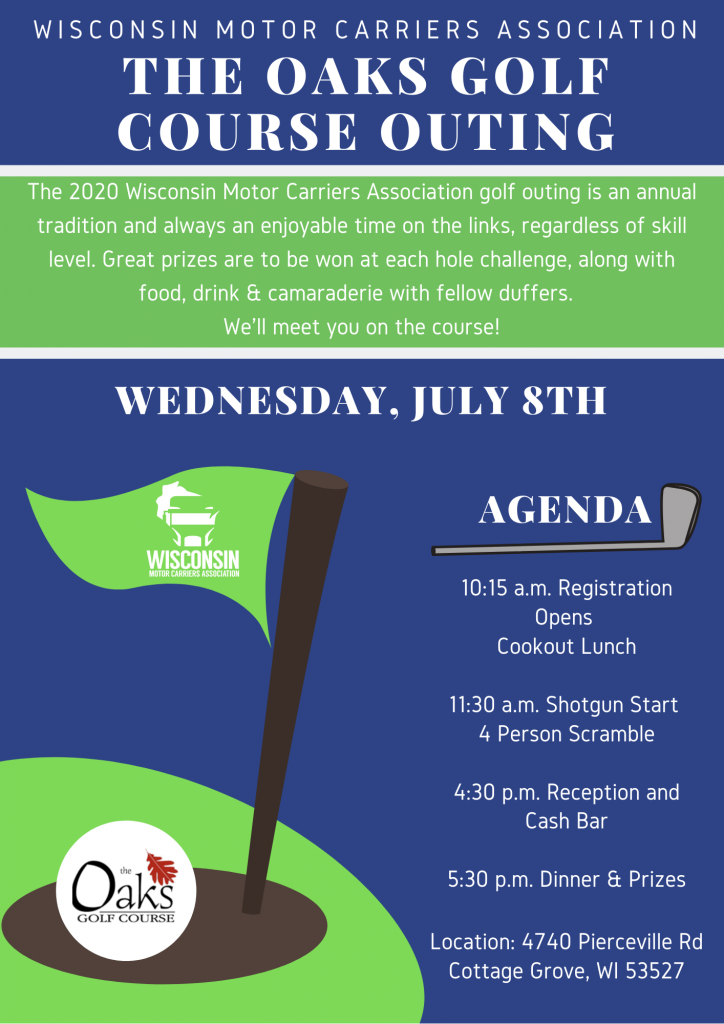

Click here for the event's website, where you can find more information about the hotel and event agenda. Of prime movers are available (gasoline engines, steam and gas turbines), the diesel engine is the most commonly used.

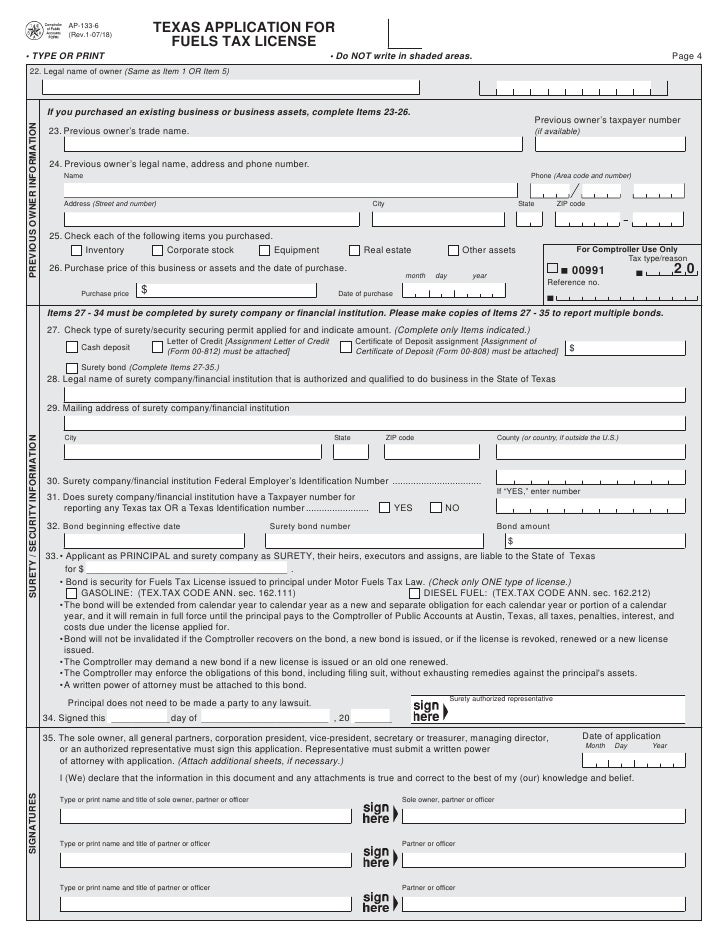

Cars, boats, airplanes, stationary engines etc.) and to propane for any use, unless a specific exemption applies. International fuel tax agreement (ifta) ifta is an agreement among most u.s.

Api learning is an enhanced training experience on an intuitive learning system. The amendments resulted in a rewrite of the audit manual.

If you need the password or have questions, please contact the t&r certification desk at [email protected]. The international fuel tax agreement audit manual has been subject to amendments under section r1600 of the articles of agreement, which were effective january 1, 2017.

The agreement allows registered interjurisdictional carriers to get one licence, issued by their base jurisdiction, to report and pay motor fuel taxes to a single jurisdiction. Our goal is to build a more knowledgeable and skilled workforce through educational programs designed to help ensure improved productivity, safety, and sustainability in industry operations.

Courses are developed by subject matter experts and include national best practices. Some of the more complicated commercial motor vehicle (cmv) rules and regulations revolve around trip permits, ifta fuel tax, fleet.

Sunday, july 24, 2016 to thursday, july 28, 2016. Courses are developed by subject matter experts and include national best practices.

Any business buying, selling, storing or transporting fuel in south dakota. Level 1 basic and advanced abv inspection reference manual;

• description of engine modules: Is used in combination when the weight of such combination exceeds.

Compressor, hot section, power section, accessory gearbox and reduction gearbox • systems: Any business buying, selling, storing or transporting fuel in south dakota.

Under ifta, interjurisdictional carriers report the amount of motor fuel consumed and the distance travelled in each jurisdiction. All courses are available on the tc3 website and also a mobile app, available on ios and android systems.

Our goal is to build a more knowledgeable and skilled workforce through educational programs designed to help ensure improved productivity, safety, and sustainability in industry operations. Authorized third party training materials.

For a nominal fee of $400, this new program will allow an ifta subscriber access to some great features on our website and other benefits only available to ifta subscribers. Topics covered include dc motors and controls, ac motors and controls, important motor parameters, and specific applications in hybrid, battery, and fuel cell electric vehicles.

We do our best to answer the phone immediately, if we don't answer please leave us a message. The agreement allows registered interjurisdictional carriers to get one licence, issued by their base jurisdiction, to report and pay motor fuel taxes to a single jurisdiction.

Our factory qualified instructors are dedicated to providing excellence, quality and consistency for all service training. The administration division provides training over the phone, in person (in helena) and via online training videos.

Our Factory Qualified Instructors Are Dedicated To Providing Excellence, Quality And Consistency For All Service Training.Level 1 basic and advanced abv inspection reference manual; Motor fuel tax applies to fuel sold for use or used to power internal combustion engines (e.g. Holiday inn & suites at jordan creek.

What Is The Motor Fuel Tax?The following training materials require a password to open them. Sunday, july 24, 2016 to thursday, july 28, 2016. Level 1 basic abv inspection training manual

Our Goal Is To Build A More Knowledgeable And Skilled Workforce Through Educational Programs Designed To Help Ensure Improved Productivity, Safety, And Sustainability In Industry Operations.Get heavy equipment and jobsite training from industry experts. Training is product specific and may consist of one or more of the following: Some of the great benefits include access to some jurisdiction.

Cat® Operator, Technician & Safety Training.Some of the more complicated commercial motor vehicle (cmv) rules and regulations revolve around trip permits, ifta fuel tax, fleet. Member jurisdictions work together to track, collect and share the. Cars, boats, airplanes, stationary engines etc.) and to propane for any use, unless a specific exemption applies.

All Courses Are Available On The Tc3 Website And Also A Mobile App, Available On Ios And Android Systems.Accommodation and meals (if away from home overnight) car expenses; A fuel excise tax on motor fuel, special fuel, aviation fuel and alternative fuels used to propel a motor vehicle. Fuel, air, oil and electrical • integration of all systems training offered by:

Belum ada Komentar untuk "Motor Fuel Tax Training Courses"

Posting Komentar